Notice: Taxes Due

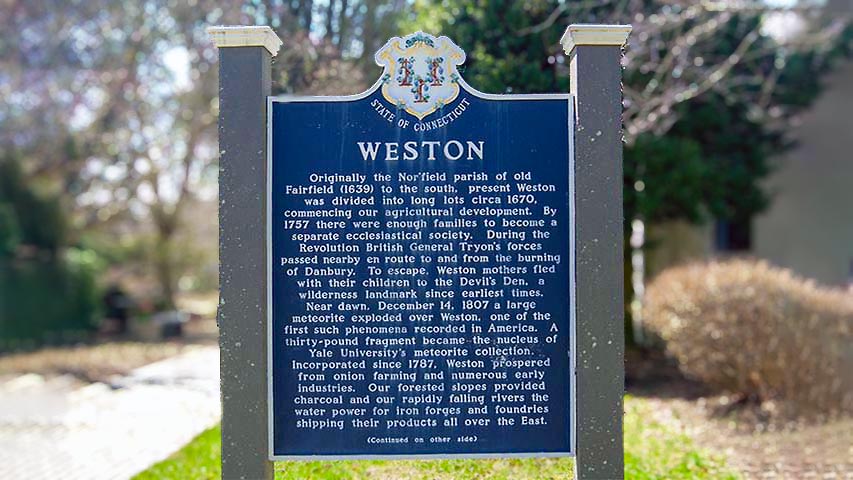

Weston Today photo

Office of the Tax Collector

Town of Weston

Notice —Taxes Due

The first installment of real estate, personal property, and motor vehicle taxes on the Grand List of October 1, 2023 is due and payable on July 1, 2024. Failure to pay by August 1, 2024 will result in a late payment with interest of 1-1/2% per month starting with the July 1st due date per State Statute 12-145. Minimum interest charge is $2.00.

If you no longer have a vehicle that you received a bill for, you must present proof to the Tax Assessor (203) 222-2606.

If you have any questions, please call our office at (203) 222-2697. Taxpayers have several options to pay their bill. You can come in during Town Hall hours from 9 to 4:30 Monday through Friday. Alternatively, you can put your payment in the drop box outside the side entrance to the Town Hall, mail the payment, pay online at www.westonct.gov, or pay by phone at (855) 844-0237. Service fees will apply. If you did not receive a tax bill, please contact the Tax Collector. Beginning on June 27th, you can also check online for payment amounts at the town website noted above.

Failure to receive a tax bill does not excuse the taxpayer from tax and delinquent interest (C.G.S.12-130).

56 Norfield Road, PO Box 1302 Weston, CT 06883 Telephone 203-222-2697